Long-term care (LTC) delivery is no longer relegated exclusively to the nursing home. Today, these long-term services and supports (LTSS) are delivered with increasing frequency in settings ranging from assisted living and senior living communities to individuals’ personal residences.

The LTC trade association LeadingAge, for example, reports that 61% of its Top 100 constituents have already diversified their service lines to include home and community based services.[i] Recent developments with accountable and managed care organizations indicate that the trend of providing care and services in less institutional settings will continue for the foreseeable future. These models’ value-based payment strategies have made effective care coordination and care transitions top priorities.

Hmmm...are we really a "long-term" industry?

Each setting within the LT-PAC network has its own distinct characteristics. Traditional nursing homes, while in the process of evolving into other service lines, are still prominent players in the care continuum. Finding specialty areas and expanding into including short-stay rehab, is becoming increasingly important to this sector. An area of significant growth in LT-PAC is short-stay rehab. For those operators, outcomes are the primary emphasis.

Assisted living (AL) is another sector undergoing significant change. Its traditional consumer base is increasingly receiving AL services in their homes, causing providers to offer new services lines, often memory care. For AL, sales and marketing technology is critical. Memory care is a hot area—the prevalence of Alzheimer’s Disease and other forms of dementia assure demand for these services well into the future. Demonstrating outcomes and interfacing with applied technologies are of interest to this sector. Finally, home and community based services (HCBS) including home health, hospice and adult day are increasingly a part of the LT-PAC system.

Nursing Homes

Skilled nursing and intermediate care properties specialize in providing intensive personal and/or healthcare services. According to the Centers for Medicare and Medicaid (CMS), there are 15,681 certified nursing facilities in the US. Of these properties:

-

55% are controlled by multi-facility organizations; 45% are independent

-

69% are for-profit; 25% are nonprofit; and 6% are government facilities

-

6% are dedicated special care units (Alzheimer’s, Rehab, Ventilator, Hospice, Aids, Other)[ii]

Traditionally the “bread and butter” segment of the continuing care spectrum, skilled nursing has been undergoing a process of “right sizing” over the course of the last decade. The number of skilled nursing facilities has been on a steady, but gradual decline. However the number of skilled nursing units overall—as well as the number of residents—has remained constant. Smaller facilities are being replaced with larger, more cost-effective plants.

This segment of the market is now on the brink of a more significant transformation. Due to such factors as demographic shifts, consumer demand and expectations, new Federal health policies and a changing state payor landscape, the standard “nursing home” is changing its focus to chronic, medically complex care and/or short stay rehabilitation services. Both consumers and payors (Medicare/Medicaid and private insurers alike) are pushing care delivery back into Home and Community Based Services (HCBS) for clients whose needs can suitably be delivered outside of a facility setting. Far from its “old folks’ home” roots, the skilled nursing facility is being challenged to care for those patients who are not ready to return home (or to lower levels of care acuity). With progressive frequency, medically complex cases requiring more intensive care and patients recovering from acute events (rehabbing from strokes, cardiac procedures, hip replacement, etc.) are the new nursing home patient.

[i] LeadingAge. Ziegler. “LeadingAge Ziegler 100.” (2013): 4

[ii] American Health Care Association. “LTC Stats: Nursing Facility Operational Characteristic Report.” (2013): March

Short-Stay Rehabilitation

Approximately one-third of hospital patients are discharged into post-acute care. The most common setting for the delivery of this care is the skilled nursing facility specializing in short-stay rehabilitation, making it one of the fastest growing service lines in the LT-PAC spectrum. Facilities providing short-stay rehabilitation offer services to patients who need additional support while recuperating after a hospital discharge.[i]

Services provided might include:

-

Physical therapy

-

Occupational therapy

-

Respiratory therapy

-

Speech therapy

-

Wound management

-

Cardiac rehabilitation

-

Pain management

-

Ventilation care

There is a determined course of treatment, often involving a therapy regimen. Typically, these services are in place to improve a patient’s transition from hospital to the community. Rehabilitation measures are taken to promote optimum attainable levels of physical, cognitive, psychological, social, emotional and economic usefulness so that an individual can maintain maximum functionality.

The emphasis of short-stay rehabilitation is on results. Payment sources for this service line (primarily Medicare, managed care and/or private insurance) demand both optimal clinical outcomes and cost-effectiveness. Having the data to demonstrate efficacy in both areas is imperative.

Assisted Living

Since each state has its own terminology and standards for this service line, there is no uniform definition for assisted living (AL) across the US. Generally speaking, however, AL supports people who have restricted functionality, due to advanced age and/or disability. Residents are in need of help with activities of daily living (ADLs) like eating, bathing, toileting or ambulating, but are encouraged to live with the highest degree of independence possible.[ii] The current service model is directed at an average resident who is 85, has one or more chronic health conditions, and requires assistance with three or more ADLs (activities of daily living). 42 per cent of AL residents have been diagnosed with some form of dementia. [iii] Services typically include prepared meals, security, organized social activities, laundry and transportation. Assisted living communities are increasingly providing clinical services such as medication management, ointment and light dressing application, and therapies to keep strength and daily function as high as possible.

AL is an extremely diverse market segment. Far from homogenous, this sector ranges from the very small to extra-large. For example, of the 31,100 AL communities accounted for by the Centers for Disease Control and Prevention (CDC):

-

50% are considered small (4-10 beds)

-

28% are categorized as large (26-100 beds)

-

7% are classified as extra-large (more than 100 beds)

Large AL communities (26 or more beds) make up 35 per cent of all AL communities, yet house a full 81 per cent of all AL residents. Conversely, small to medium sized communities significantly outnumber larger communities, but account for only 19 per cent of all residents. [iv]

The sector is more homogenous in other demographic characteristics:[v]

-

82% of AL communities are privately owned for profits

-

The remaining 18 percent (about one in six) are nonprofit or owned by state, city, or local government

-

62% are owned by independent operators (particularly smaller communities)

-

Approximately 38 percent of facilities are chain-affiliated

The same trends causing skilled nursing to change its service and operational model will have a significant impact on assisted living as well. The services provided by assisted living are more readily transferred to less congregate settings. The sector is beginning to respond by converting traditional assisted living units into memory care units. In fact, complete memory care wings—and entire communities—are beginning to emerge as a major trend within the long-term care continuum.

Memory Care

An emerging sector in long-term care and senior living is memory care. Typically housed within a skilled nursing or assisted living community, memory care units cater to consumers with Alzheimer’s disease (AD) and other forms of dementia. The statistics are staggering. One in nine people age 65 and older are afflicted with AD and about one-third of people age 85 and older have the disease. As life expectancy increases and the population ages (more rapidly, now that Baby Boomers have begun turning 65), the sheer number of Alzheimer’s cases alone is expected to mushroom. By 2025, the number of people 65 and older with Alzheimer’s disease is expected to increase by 30 per cent. Some project the number of AD cases to triple within one generation.[vi]

Upward trends in life expectancy and the aging of the US population are what make the memory care offering so popular. Assistance with ADLs and care management of chronic conditions are services more easily transferred to HCBS. Cognitive impairment, however, poses unique challenges and risks—and is often more easily addressed in a congregate setting. While this sector is small, compared to the other service sectors, the growth change for memory care surpasses all other sectors.

Home and Community Based Services

Home and Community Based Services (HCBS) is a term used to describe an array of non-institutional care alternatives. When describing HCBS, the word “community” is used in a broader sense which can include a person’s home as well as other locations within the general community. Development of HCBS remains a priority for many public healthcare programs. In addition to the cost savings these programs are expected to generate, it is also the desire of most consumers to receive care and services in the least institutional setting possible. For the purposes of LT-PAC delivery, those service lines include home health, hospice/palliative and adult day care.

Home Health Care

As the name implies, home health care services are provided in a person’s place of residence. The home may be a single family home, apartment, or senior living community. Home health services are frequently provided after a hospitalization or short-term rehab stay to assist in a patient’s transition back home. Home health care encompasses such services as assessments, provision of care, treatment, counseling and/or monitoring of clinical status. These services are delivered by a host of professionals including nurses, physical therapists, occupational therapists, speech therapists, audiologists, dentists, social workers, dieticians, and more. Home health care is usually provided when a person requires intermittent care (a few hours per day/a few days per week), rather than full-time.[vii] If more regular, round-the-clock care is required, a facility-based model of care is usually recommended for cost-effectiveness.

Hospice Care

Often referred to as “end-of-life care,” hospice services are provided to individuals diagnosed with terminal illnesses who have a limited life expectancy (usually defined as six months or less). Care provision departs from the traditional model of clinical treatment and instead focuses on the palliative management of pain and other symptoms. Meeting a person’s emotional, psychosocial and spiritual needs is a primary focus, as is assisting the family to cope with the loss of a loved one.

Adult Day Care

A form of long-term care, adult day care provides interim (less than 24-hour) assistance for individuals who require supervision or assistance, but not round-the-clock nursing care. These community-based programs are designed to provide a safe setting for the provision of social and health services. They also provide a respite for caregivers in need of a break from the demands of their caregiving role. There are several popular models of adult day care services. The social model provides meals and supervised activities. A more medical approach focuses primarily on the delivery of health care. Specialty models have developed as well, offering services for those with dementia, brain injuries, and other chronic conditions.[viii]

Summary

What was once a safety net for our nation’s elderly has evolved into an ever-more-complex and interwoven system of long-term services and supports for a broad population of Americans. The medical model of old has evolved into a person-centered paradigm, wherein the money follows the patient. Today’s long-term/post-acute care now encompasses skilled nursing, short-stay rehab, assisted living, memory care, and an array of home and community-based services. Consumer demand and the advent of ACOs and MCOs are driving significant change. Fee-for-service is being replaced by value-based payment. LT-PAC providers must demonstrate their outcomes and cost-effectiveness just to survive.

[i] Pratt, John R. Long-Term Care: Managing Across the Continuum. 3rd Edition. Sudbury, Mass.: Jones and Bartlett Publishers, 2010.

[ii] McSweeney-Feld, Mary Helen. Oetjen, Reid. (Eds.) Dimensions of Long-Term Care Management, An Introduction. Chicago: HealthAdministration Press, 2012.

[iii] Mollica, Robert. Houser, Ari. Ujvari, Kathleen. “Assisted Living and Residential Care in the States in 2010.” AARP Public Policy Institute, 2010.

[iv] Ibid

[v] Ibid

[vi] Alzheimer’s Association. 2012 Alzheimer’s Disease Facts and Figures. Alzheimer’s & Dementia. Volume 8, Issue 2

[vii] Pratt, John R. Long-Term Care: Managing Across the Continuum. 3rd Edition. Sudbury, Mass.: Jones and Bartlett Publishers, 2010R.

[viii] McSweeney-Feld, Mary Helen. Oetjen, Reid. (Eds.) Dimensions of Long-Term Care Management, An Introduction. Chicago: Health Administration Press, 2012.

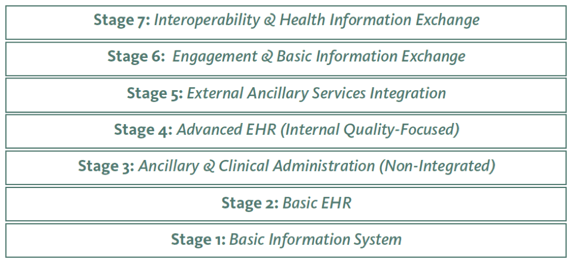

viders had an electronic health record (EHR) adoption blueprint that guides them through the process, step by step, to implementation? That’s exactly what LeadingAge’s Center for Aging Services Technology (CAST) has done.

viders had an electronic health record (EHR) adoption blueprint that guides them through the process, step by step, to implementation? That’s exactly what LeadingAge’s Center for Aging Services Technology (CAST) has done. s new 7-Stage Adoption Model was tailored to help long-term care providers not only improve efficiency, but also quality of care for their residents.” He also said that he hopes the model will make it easier for more and more providers to integrate advanced EHR functionalities into their operations, and use them to continuously improve care quality.

s new 7-Stage Adoption Model was tailored to help long-term care providers not only improve efficiency, but also quality of care for their residents.” He also said that he hopes the model will make it easier for more and more providers to integrate advanced EHR functionalities into their operations, and use them to continuously improve care quality. Americans 40 years and older. I am among that group, and we are, for the most part, unprepared to pay for long-term care (something many of us will need in the second half of our lives), uninformed about how it will or can be paid for, and reluctant to go anywhere else but to our own bedrooms to be cared for if or when we need that care.

Americans 40 years and older. I am among that group, and we are, for the most part, unprepared to pay for long-term care (something many of us will need in the second half of our lives), uninformed about how it will or can be paid for, and reluctant to go anywhere else but to our own bedrooms to be cared for if or when we need that care.

example.

example. This assertion is not a new one for Thomas, who had just finished his

This assertion is not a new one for Thomas, who had just finished his  is of our own creation. We manufacture disability, frailty, weakness, and we create it on a massive scale.”

is of our own creation. We manufacture disability, frailty, weakness, and we create it on a massive scale.”