Payment reform is the new driver of innovation in long-term and post-acute care, according to Laurence Gumina, CEO of Columbus-Ohio-based Ohio Living (formerly Ohio Presbyterian Retirement Services). He conveyed his message via a session at the LeadingAge annual meeting last month, along with his colleague, Wendy Price Kiser, executive director of Ohio Living Home Health & Hospice of Greater Toledo.

Gumina recently led the organization through a new strategy development and name change, and the results are indeed innovative. With 12 life plan communities, a home he alth and hospice care agency, and a foundation under its umbrella, Gumina says he wanted to step outside the boundaries of a typical model and create an innovative value proposition that would be effective in moving the organization into the new world of value-based purchasing.

alth and hospice care agency, and a foundation under its umbrella, Gumina says he wanted to step outside the boundaries of a typical model and create an innovative value proposition that would be effective in moving the organization into the new world of value-based purchasing.

What’s more, Gumina saw the writing on the wall; he knew he had to be proactive about adapting to the new payment reforms before it was too late. Another significant factor in Ohio Living’s drive to be more innovative is the impending SNF readmission measure that takes effect fiscal year 2019.

The most interesting of Ohio Living’s new models, in my opinion, is its successful home health and hospice services. Branded as the Home to Stay Program, it was created to improve quality and reduce hospital readmissions for patients.

In outlining Home to Stay’s highly successful relationships with two ACOs, Price Kiser noted that although it took their first partner six months to respond to her call, the care coordination model is now a valued component in the ACO’s continuum. “We told them that we wanted to work with them and that we would see all of the discharges coming out of the hospital,” said Price Kiser. Yes, she said ALL of their discharges. It was a risky offer to provide free transitional care to some patients but they bet on the fact that it would enhance their value proposition for the ACO--and it worked.

And like many creative and innovative models that are rooted in everyday common sense, so too is Ohio Living’s. As Price Kiser said: “It isn’t rocket science.” With some “basic clinical judgment” baked into the program, she pointed to a simple yet critical factor in their model: caregivers meet with the patients the very next day after they are discharged. In addition, they focus on two things: medication safety and medication reconciliation.

Here’s how it works:

- Day 1-Coach Visit: The patient signs a consent form, the caregiver conducts a medication reconciliation, takes vitals, creates a personal emergency plan, does a fall risk assessment, confirms a follow-up appointment with (and transportation to) a primary care provider.

- Day 8 – Coach Visit: Review any red flags, determine signs and symptoms and coach interventions, follow up on any issues identified during the first visit, review medication plan, and determine if any PCP appointments and medication changes are necessary.

- Day 17 – Coaching Call: Confirm a PCP visit was made and discuss the results of the visit.

- Day 22 – Coaching Call: Determine signs and/or symptoms and coach interventions, if necessary.

- Day 30 – Coaching Call: Determine signs and/or symptoms and coach interventions and discharge from the program.

As of October, the cumulative hospital readmission rate was 3.6 percent, Price Kiser reported.

Also successful is Home to Stay’s involvement in a Comprehensive Joint Replacement model. Similar to its ACO model, tracking metrics and a focus on patient engagement and education are key to preventing avoidable readmissions under the CJR, Price Kiser said.

The two presenters offered some additional advice for providers seeking their own secret sauce for innovation: Create a value differentiator—something that makes your organization memorable; seek new and unique partnerships; and, last but not least, track metrics, analyze them, and share that data with potential partners.

If you want to create innovative new services or business lines, facilitated by experts in the senior living field, with candid feedback, contact Quantum Age today.

That means your own website’s pages are in competition with each other, and with tons of other pages.

That means your own website’s pages are in competition with each other, and with tons of other pages. m particularly excited about one individual on the OPTIMIZE agenda, Jennie Bucove, founder and CEO of

m particularly excited about one individual on the OPTIMIZE agenda, Jennie Bucove, founder and CEO of  se and had lived in multiple long-term care centers. “He had been kicked out of every facility because of his disease, so Mike decided to create a community on his own,” Bucove explains.

se and had lived in multiple long-term care centers. “He had been kicked out of every facility because of his disease, so Mike decided to create a community on his own,” Bucove explains.

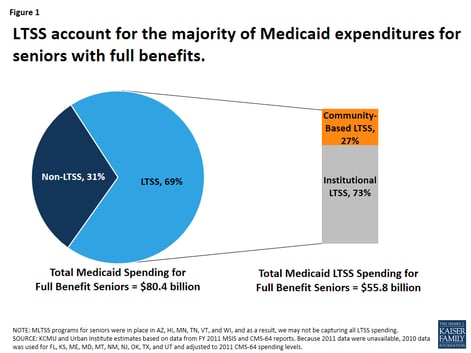

Medicaid has become a safety net for many seniors who need long-term services and support (LTSS), but it appears to be stretched too thin.

Medicaid has become a safety net for many seniors who need long-term services and support (LTSS), but it appears to be stretched too thin.

nts, according to the latest troubling results from the program’s trustees

nts, according to the latest troubling results from the program’s trustees